flow through entity taxation

A flow-through entity FTE is a legal entity where income flows through to investors or owners. FTE Tax Credit FAQs.

Sole Proprietorships And Flow Through Entities Ppt Download

Notice IIT Return Treatment of Unemployment Compensation.

. Trade or business of a flow-through entity is treated as paid to the entity. Entities must make an. The range of features that comprise each method of taxation entity taxation and flow-through taxation are set out in previous work see here and here.

Eligible entities can make the election for the 2022 New York State PTET through September 15 2022 using the Pass-Through Entity Tax Annual Election application. City Individual Income Tax. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest.

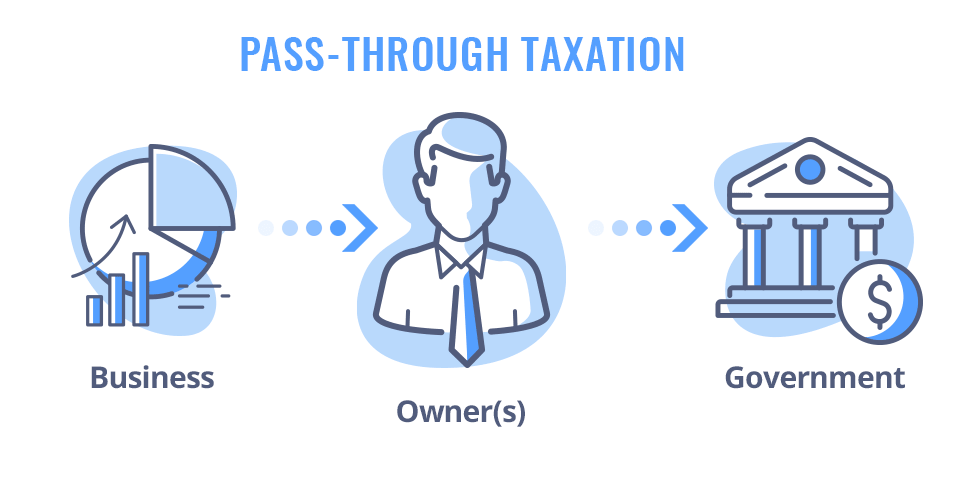

A flow-through entity is a business in which income is passed straight to its shareholders owners or investors. My recent article critically analysed. Understanding What a Flow-Through Entity Is.

With sole proprietorships LLCs partnerships and S corporations business income flows through to the business owners and is taxed only at the individual. Because of the increasing use of such flow through entities for a variety of business issues at the state level continue to assume even greater prominence. This rule applies for purposes of Chapter 3 withholding and for Form 1099 reporting and backup withholding.

However the late filing of 2021 FTE returns will be. A flow-through entity is also called a pass-through entity. A foreign part See more.

To calculate and report the annual Flow-Through Entity tax FTE tax under Part 4 of the Michigan Income Tax Act for a flow-through entity FTE that has made an election to file and pay the. Is elected and levied on the Michigan portion of the positive business income tax base of a flow-through entity. This amount generally correlates to the business.

City Individual Income Tax. All of the following are flow-through entities. FTE Tax Credit and.

As a result only the individuals not the business are taxed. Flow-Through Entity FTE Tax Credit. City Business and Fiduciary Taxes.

You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. This means that the flow-through entity is responsible. Instead their owners include their allocated shares of profits in.

Income that is or is deemed to be effectively connected with the conduct of a US. Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. Types of Pass-Through Entities.

General FTE Tax Credit. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. Flow-through entities are considered to be pass-through entities.

That is the income of the entity is treated as the income of the investors or owners. Instead all income of the business is passed through to the owners who report it on their personal income tax return and pay taxes at their effective marginal rate. A trust maintained primarily for the benefit of.

View FTE Business Tax FAQ. City Business and Fiduciary. Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated.

FTE Tax Credit FAQ. The Michigan FTE tax.

Pass Through Entity Definition And Types To Know Quickbooks

Elective Pass Through Entity Tax Wolters Kluwer

Pass Through Entity Definition And Types To Know Quickbooks

Pass Through Entity Definition Examples Advantages Disadvantages

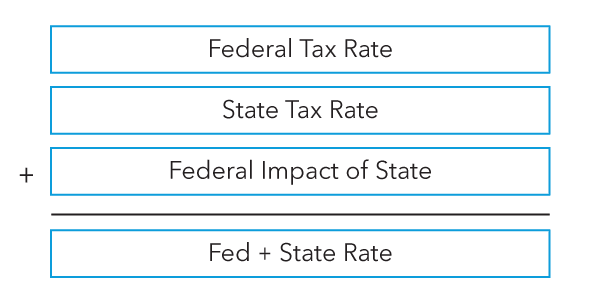

Accounting For State Income Tax Provision Under Asc 740 Bloomberg Tax

Pass Through Entity Definition Examples Advantages Disadvantages

How To Choose Your Llc Tax Status Truic

Pass Through Entity Tax 101 Baker Tilly

The Other 95 Taxes On Pass Through Businesses Econofact

Jp Magson Private Client Wealth Management

Pass Through Entity Definition And Types To Know Quickbooks

Ab150 Creates Elective Pass Through Entity Tax

Flow Through Entity Overview Types Advantages

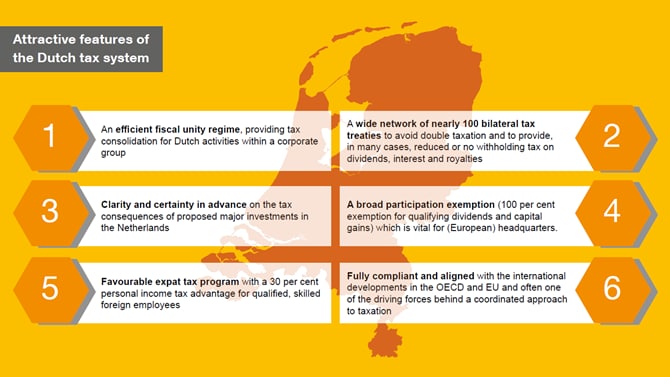

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

What Is A Pass Through Entity Definition Meaning Example

Pass Through Taxation What Small Business Owners Need To Know

What Is A Pass Through Entity Youtube